In a column written for the Healthcare Markets Magazine, PHINs healthcare data analysts, Amna Talat, Josh Vaughan, and graduate healthcare data analyst Dhirav Patel look at how the data PHIN collects can provide insight into patients’ choices around cosmetic surgery

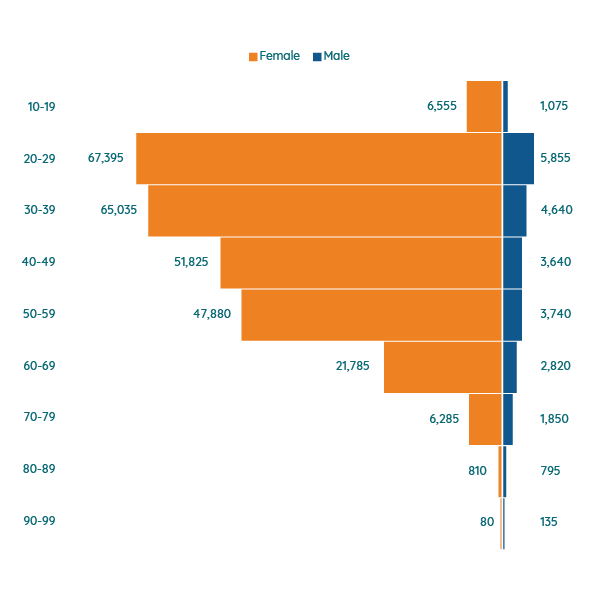

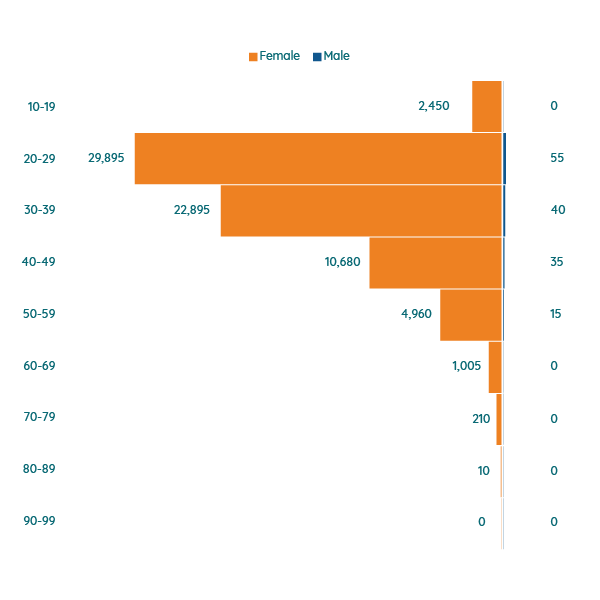

The data we have collected about elective, private in-patient procedures over the past six years provides some interesting insights into the market. It comes as no surprise that the majority of cosmetic procedure patients continue to be female and that most cosmetic procedures are paid for using self-pay (80%) rather than private medical insurance (20%) which often won’t cover cosmetic procedures.

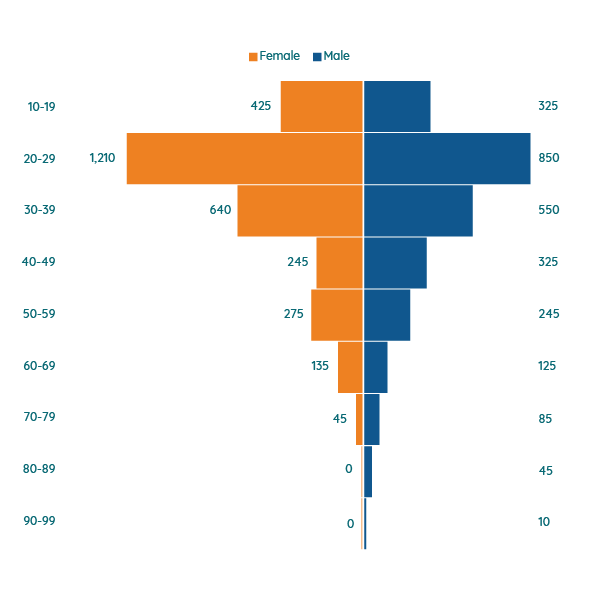

Figure 1: Procedures by 10-year age band and gender

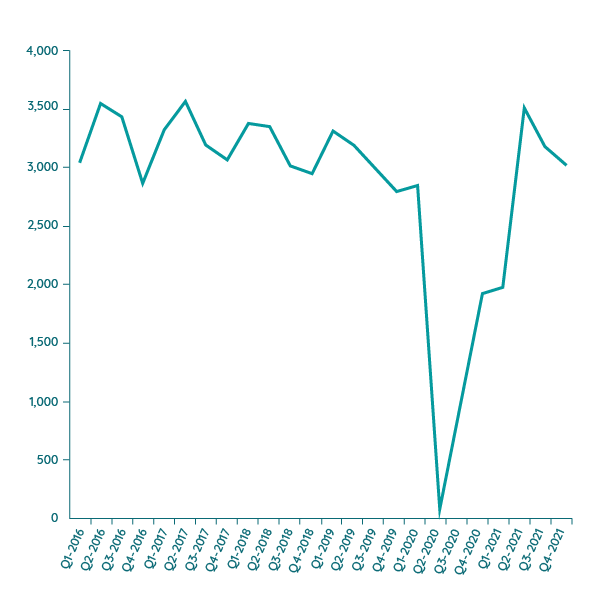

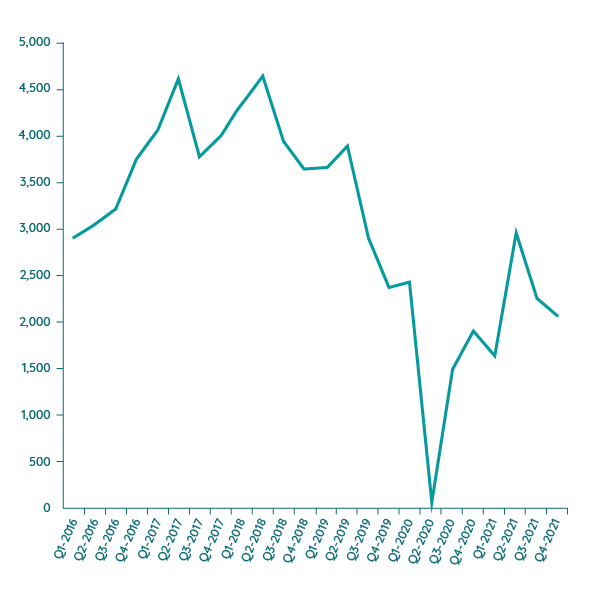

However, looking into the data in more detail shows that there is a seasonality to cosmetic procedures. The most popular time of year to have a cosmetic procedure is quarter 2 (April to June). There are clear spikes when looking at overall procedures (see figure 1) in this period (except for during the Covid lock down period). For some procedures, notably breast augmentation, this could represent patients’ desire to be ‘beach/summer body’ ready in response to marketing campaigns around at the time.

It is also possible that the quarter 2 spike ties in with bonus payments or pay increases for those working in the traditional financial year (1 April to 31 March) meaning they have more disposable income at that time.

The seasonality of procedures is though mostly influenced by the recovery period and how that impacts on the patient’s lifestyle. Recovery from all cosmetic procedures is at least 8-12 weeks to return to full activity and cosmetic patients don’t get sick leave for the surgery. Cosmetic surgery is, therefore, less popular in the summer (June to late August) because most patients who can afford cosmetic surgery don’t want to ruin their summer holiday.

Although the number of admissions falls in quarter 3 and 4, it is often a more popular period for those with older children who may choose the summer so they can be looked after by them. This ‘older demographic’ with more responsibilities also often chooses the autumn/winter period for facial procedures so they can hide away to recover.

Figure 2: Procedures per quarter

As well as these seasonal variations, the Covid-19 pandemic appears to have influenced the type of cosmetic procedures that people are choosing. Perhaps because of the increased amount of time we’re spending on video calls and the resulting focus on our faces, facial cosmetic procedures (brow lifts, eye lifts, eyelid lifts, face lifts and rhinoplasty) and have bounced back well following the lock down restrictions.

Figure 3: Facial procedures by quarter

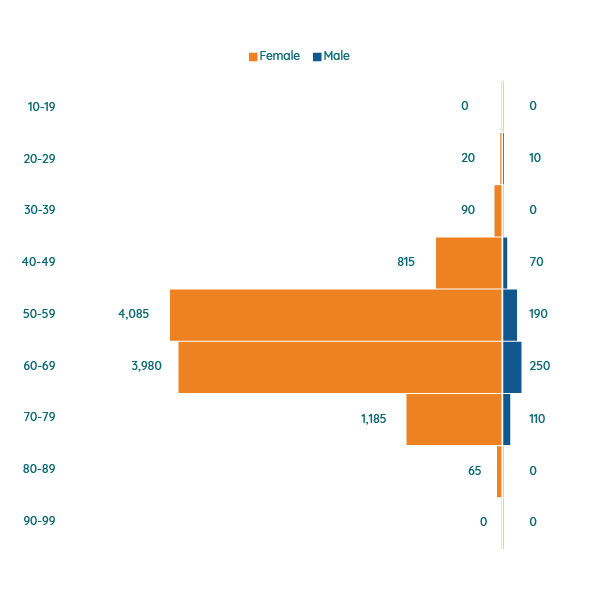

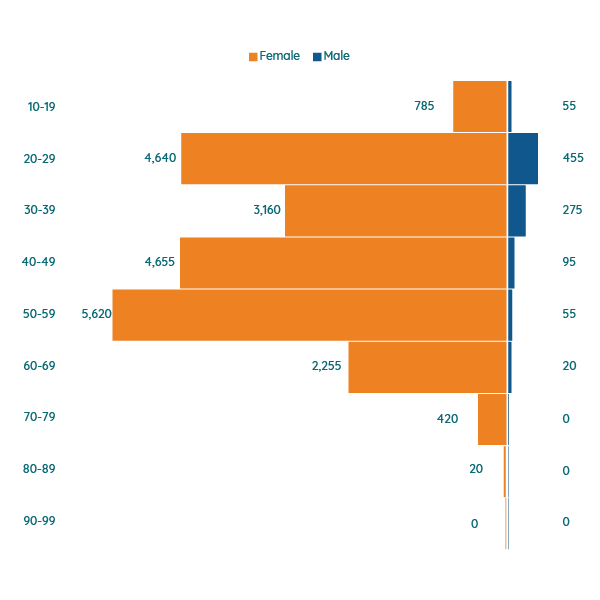

Figure 4: Face lift procedures by age and gender

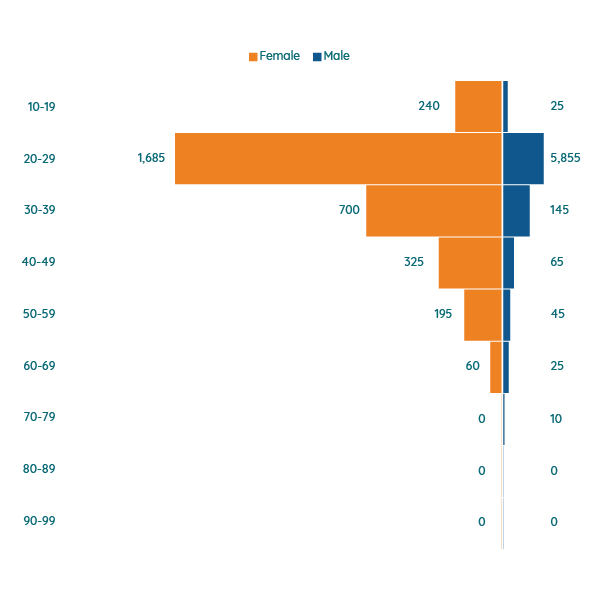

Figure 5: Cosmetic Rhinoplasty procedures by age and gender

Face lifts are popular among women in their 50s and 60s, whereas rhinoplasty surgeries are favoured by women in their 20s.

From 2016 to 2021, approximately 43% of facial cosmetic procedures took place in London (19,000) and the North West (10,000). The South East was the next highest (9,000). The East Midlands, North East and Wales were lowest with 2,000 each.

External Ear surgery procedures are carried out fairly evenly across the UK, for similar numbers of women and men and most often in the 10-19 and 20-29 age brackets. Men continue to have the procedure into their 80s and 90s.

Figure 6: External ear plastic surgery procedures by age and gender

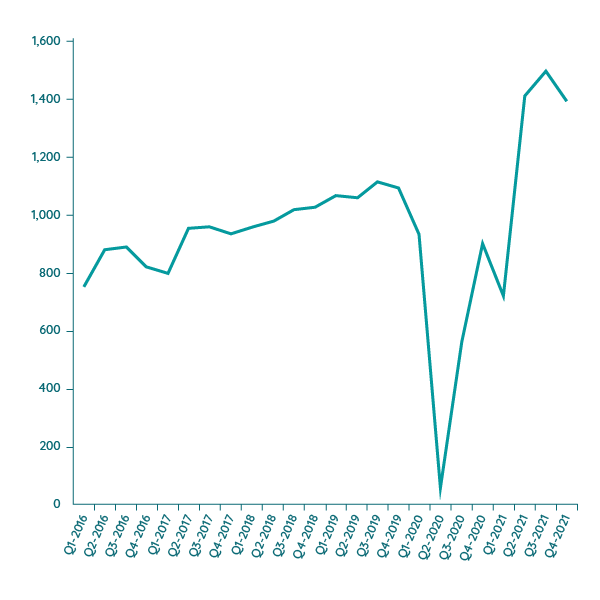

Potentially linked to a move away from formal clothes to more comfortable ones since the lockdowns, or an increased amount of time in front of computer screens, breast reductions are at a higher level than pre-Covid. Although most popular among those aged 50-59, breast reductions are also popular for those in the 20-29 and 40-49 age groups.

Figure 7: Breast reductions by quarter

Figure 8: Breast reduction procedures by age and gender

Although figures spiked in Q2 2021, breast enlargements have yet to return to pre-pandemic levels. They do remain very popular procedures for women in their 20s and 30s, with nearly 53,000 of these procedures being carried out for these age groups.

Figure 9: Breast enlargements by quarter

Figure 10: Breast enlargement procedures by age and gender

Over the past six years, the geographical distribution of breast reduction procedures has been fairly evenly spread across the UK with the most procedures taking place in London (5,000) and the North West (3,000) going down to 1,000 in the East Midlands, North East and Wales.

For the same period, almost half of breast enlargement procedures have been carried out in London (23,000) and the North West (18,000), with the West Midlands being the next highest area at (8,000). The East Midlands had the lowest number of breast enlargement procedures (1,000).

A temporary adjustment or ongoing trend?

The quarter 2 spike is now well established and has returned post-lockdown so appears to be a phenomenon worth catering for. Providers could choose to focus their marketing efforts around this period, and it certainly looks like cosmetic consultants should avoid going on holiday themselves at this time of year if they don’t want to miss out on business.

We will have to wait longer to see whether the increase in breast reductions becomes a trend and whether breast enlargements return to their former popularity or whether the changes since the pandemic are the ‘new normal’, but it something worth keeping an eye on for practice management and providers.

We will continue to collect data and publish relevant information on our website: www.phin.org.uk to benefit healthcare providers as well as the patients they serve.