Here we look at the key trends happening in the sector for the beginning of 2022, as seen from our unique, national dataset.

We look at what’s happening in the private healthcare market, with a focus on self-pay which continued to be a significant factor.

Market activity

%20Admissions%20comparison%20Q1%202019%20-%20Q1%202022.png)

In the latest available quarter (January to March 2022) providers reported almost 200,000 private patient admissions. This is higher than the level of activity reported for (pre-pandemic) quarter 1 in 2019. It is also the second highest rate over the past three and a quarter years.

Self-pay remained high and insurance cases increased

Self-pay figures remained high, though Q1 2022 was slightly lower than the previous three quarters (it was still the fourth highest figure and the highest Q1 figure for the past four years, and 36% up on Q1 2021).

After falling in Q3 2021, the number of people receiving treatment on an insured basis continued to increase and was the highest since the pandemic (though remained below pre-pandemic levels). In the latest reported quarter insured activity was 11% below the comparative period in 2019, but at the same level as Q2 2021.

NHS private patient services activity in self-pay and insured cases fell slightly from the previous quarter and remained below pre-pandemic activity levels. Self-pay was down 29% and insured cases down 49% from Q1 2019.

Self-pay in the regions

%20Self-pay%20admissions%20by%20region%20or%20nation.jpg)

London continued to be the most active self-pay market, with over 13,000 self-pay admissions between January and March 2022, but it had the lowest rate of growth. The South East remained the next most active with just over 11,000 self-pay admissions during the reporting period, although it was the third lowest in terms of growth.

Wales saw the largest increase in self-pay admissions (115%) in the quarter and was the only nation or region with an increase in insured admissions (12%).

Scotland continued to see a strong growth in self-pay admissions (up 72%), but its insured admissions were down 18%.

Self-pay trends for common procedures

%20Self-pay%20admission%20by%20top%2010%20procedures2.jpg)

With over 12,000 procedures, cataract surgery continued to be the largest area of activity for self-pay procedures (up 56% on Q1 2019). However, in terms of growth hip replacement (primary) and knee replacement (primary) had the highest increase (each with triple digit increases) and inguinal hernia repair procedures up 93%.

Other procedures making up the top 10 included: knee arthroscopy (up 52%), epidural injection (up 29%), diagnostic upper GI endoscopy (up 21%), and diagnostic colonoscopy – bowel (up 18%).

Two procedures, breast prosthesis and breast enlargement, both showed falls (-8% and -47% respectively).

Active consultants in private healthcare

%20No%20of%20unique%20consultants.png)

Following a traditional seasonal fall in December, the number of consultants actively treating private patients continued to grow month on month in Q1 2022. March 2022 saw the fourth highest number active since the pandemic began. However, this figure was still 10% below March 2019.

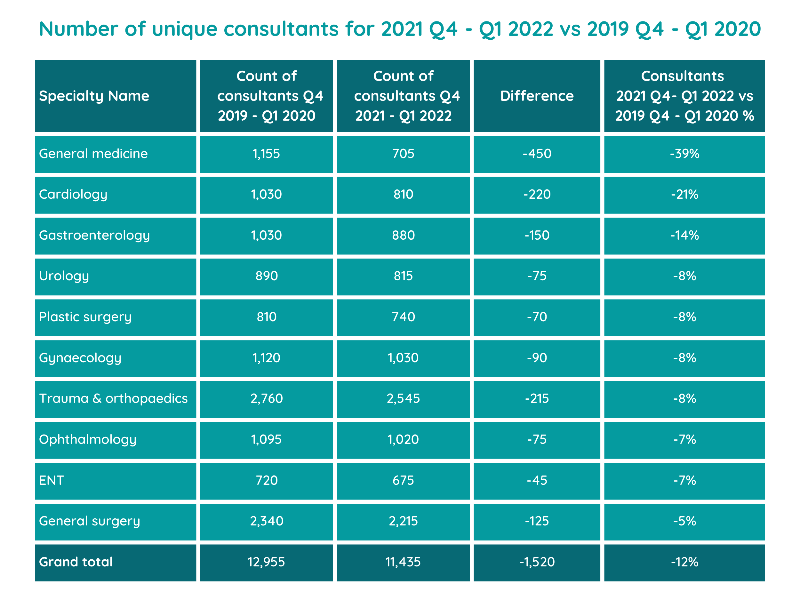

Volume of consultants by Top 10 specialty

There was a fall in the number of active consultants for each of the top 10 specialties. This was most pronounced for general medicine (down 39%) and cardiology (down 21%). The lowest change was general surgery (down 5%).

ENT replaces medical oncology in the top 10 specialties from the previous reporting period.

Important notes

All data described above taken from PHIN’s unique, national private dataset describing admitted activity (day case and inpatient). This excludes activity outside of PHIN’s mandate from the Competition and Markets Authority, such as outpatient diagnostics and mental health.

Activity numbers have been rounded to the nearest 5, with percentage based on the unrounded figures.

Admissions comparison Q1 2019 - Q1 2022.png)