Through the Covid-19 pandemic, PHIN has been charting the impact on private healthcare in the UK.

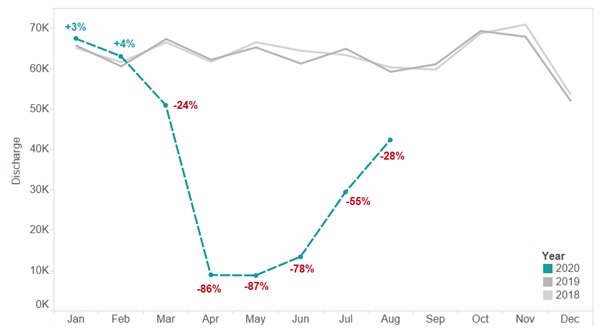

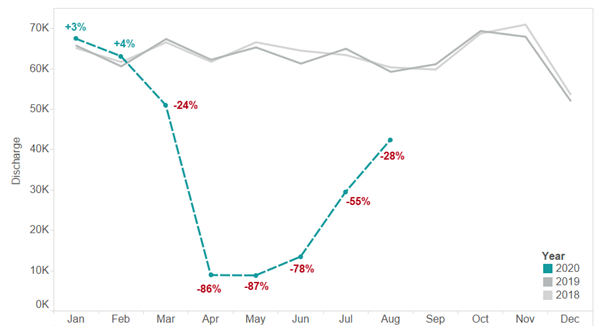

The latest figures covering both self-pay and insured elective private healthcare show that private admissions have continued to recover following lockdown earlier in the year.

Following a steady recovery from June to July, when private activity was at almost 50% of activity in 2019, August has seen that recovery continue. In August there were more than 40,000 private admissions in the UK, which is more than two-thirds of the admissions in 2019.

Estimated count of private episodes [1]

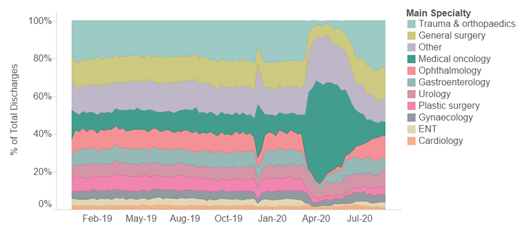

While the admission numbers are still down on last year, looking at activity by consultant specialty we can see that the make-up of the activity within the market seems to be returning to a similar pattern to earlier in the year, before the pandemic.

Private activity by specialty as % admissions

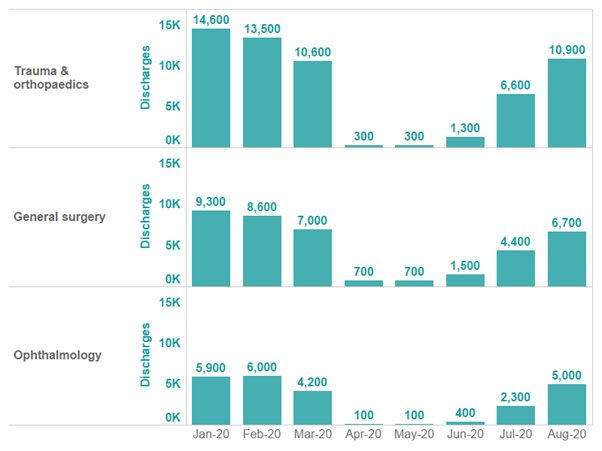

Recovery within the market has been chiefly driven by a few specialties – Trauma and Orthopaedics, General Surgery, and Ophthalmology. These have seen the largest recovery, with Ophthalmology more than doubling from July (2,300 admissions) to August (5,000 admissions). Trauma and Orthopaedics has seen the single largest increase in admissions, with 4,300 more admissions from July to August.

Trauma & Orthopaedics, General Surgery, and Ophthalmology – estimated admissions and market share

Of the most prominent specialties in private healthcare only Cardiology saw a drop in activity in August, down to 600 admissions from 700 in July. To date, no specialties have yet recovered to the same levels of activity from before the pandemic. Elsewhere, Plastic Surgery continues to be the slowest recovering specialty. There were only 1,700 estimated admissions for Plastic Surgery in August, which is less than 40% of what it was in February, when there were 4,300 admissions.

PHIN has published an interactive report, available below, that shows estimated volumes and market share for each of the ten most common specialties in private healthcare for 2020.

Interactive graph: Estimated admission and market share

“Based on the data we continue to receive from hospitals, we are seeing activity steadily increasing and the balance of activity returning to pre-Covid levels. While the market for acute private healthcare hasn’t yet fully recovered, these are positive signs.

“However, it’s not clear what impact a second Covid-19 wave over winter will have, particularly with different regional restrictions in place. We will continue to monitor this.”

Dr Jon Fistein, PHIN’s Chief Medical Officer

Notes to Editors

Admissions are counted as the number of hospital stays that have been completed within our reporting period. YoY change are calculated using sites with confirmed volumes for 2020 and 2019 for each month, removing influence of delay in private data submissions due to Coronavirus. 2020 volumes are estimated based on sites with confirmed activity. Estimates assume these sites are representative of the entire market, with confidence varying depending on number of submitting sites.

Typical sites submitting per month: 400

- January 2020: 243 Sites

- Feb 2020: 237 Sites

- March 2020: 216 Sites

- April 2020: 133 Sites

- May 2020: 133 Sites

- June 2020: 153 Sites

- July 2020: 183 Sites

- August 2020: 111 Sites

To receive the estimated admissions (counted at discharge data) and market share for Jan – July 2020, please contact press@phin.org.uk